“Over the long-term, environmental, social and governance (ESG) issues- ranging from climate change to diversity to board effectiveness- have real and quantifiable financial impacts…” So noted BlackRock chief executive Larry Fink in the wake of the Paris Climate agreement, following the United Nations’ (UN) adoption of the Sustainable Development Goals.

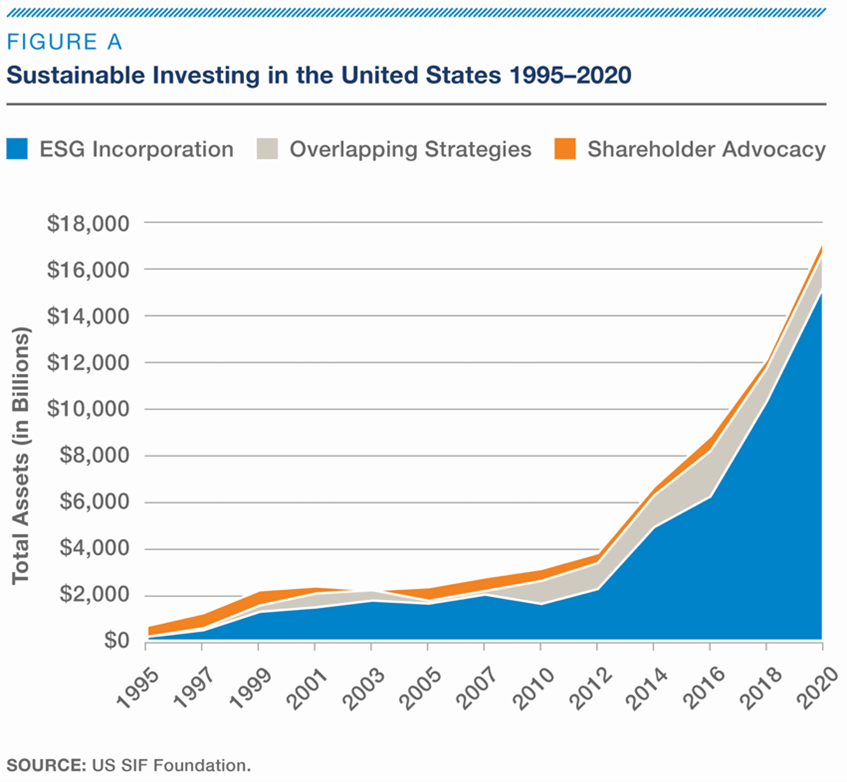

Since Fink’s 2016 annual letter, the demand to expand the concept of fiduciary duty to include Environmental, Social and Governance (ESG) concerns has intensified amongst investors and legislators alike.

In Europe, Christine Lagarde, the head of the European Central Bank and Mark Carney, former governor of the Bank of England, have both long advocated the adoption of monetary policy and banking supervision to combat climate change, supported by the need for improved corporate disclosures. In Asia, the largest asset owners, including Japan’s Government Pension Investment Fund, are demanding investment managers better integrate the ESG criteria into their investment decision-making processes.

The body of evidence to support the growth in sustainability focused investing is considerable and growing.

Morning star’s categorization of funds actively engaged in sustainable investing, boasts 204 members with $77bn in collective assets, with half of those funds launched in the last three years. In 2020 alone, close to 500 ESG funds were launched, with many investment managers announcing plans to force companies to cut their emissions and finance new projects.

Nor are investors and legislators alone in embracing a new model for corporate governance. Since 2018, the total number of firms that have committed to set emission goals in accordance with the Science-Based Targets Initiative (SBTI), a joint initiative intended to increase corporate ambition on climate action, has increased from 216 to over 1250.

At the same time, the number of organizations committed to disclosures framed by the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) has grown from 580 to nearly 1900. (The TCFD is an industry-led initiative created to develop a set of recommendations for voluntary climate-related financial disclosures.)

Consequently, the demand for more accurate and more consistent ESG data to support investors in the portfolio securities selection process, has grown dramatically. That demand in turn has highlighted several significant complications.

Complications

A Kingdom of Loose Ends

The first of which is the absence of a global regulatory standard designed to evaluate outward impacts as part of the investment process :

- The Global Reporting Initiative (GRI), established in 1997, focuses on metrics that shows the impact of firms on society and the planet. It has been embraced by close to 6,000 firms worldwide.[1]

- By contrast, the Sustainability Accounting Standards Board (SASB), which is gaining significant ground in the United States) includes only ESG factors that have a significant effect on a firm’s financial performance.[2]

- The Task Force on Climate-related Financial Disclosures (TCFD) and the Carbon Disclosure Project (CPD) both focus on climate change—primarily companies’ exposure to its physical effects and to potential regulations to reduce carbon emissions.[3]

- The International Financial Reporting Standards Foundation (IFRS) will present a proposal to the United Nations in November of this year to establish a global sustainability standards board.

- Finally, the European Union plans to adopt standardized processes through its Non-Financial Reporting Directive (NFDR) and Sustainable Finance Disclosure Regulation (SFDR). Both measures will form part of a broader suite of ESG initiatives designed to direct funding to genuinely sustainable, rather than so-called ‘greenwashed’ investments. These will facilitate compliance with the Paris Agreement climate targets and the EU’s commitment to adopt the UN’s 2030 Sustainable Development Goals.

While investors rightly lament that the diversity of standards thwarts comparability, the lack of comparability between standards is a consequence of a more fundamental complication.

What to measure, what to manage

That is, the lack of regulatory consensus as to which ESG risk factors should be measured and how:

- Of the three categories represented by ESG, Environmental criteria is the most mature, with a focus on active disinvestment in companies that produce many externalities—costs not captured in the manufacturing process—like carbon or waste or other forms of pollution.

- Governance criteria, relating to how a company structures its board, disclosures, compensation and so on.

- Whilst neither category is without difficulty, both pale in comparison to the difficulties posed by measuring social criteria. This often involves labor rights, compensation, and fatalities, as well as the ability to pursue a grievance; and issues such as the categorization of employees by gender and ethnicity. A study by NYU’s Stern School (“Putting the ‘S’ in ESG”) examined 12 of the most popular approaches, extracting more than 1,700 different measures required to assess a firm’s commitment to social sustainability alone.

Agreeing to Disagree

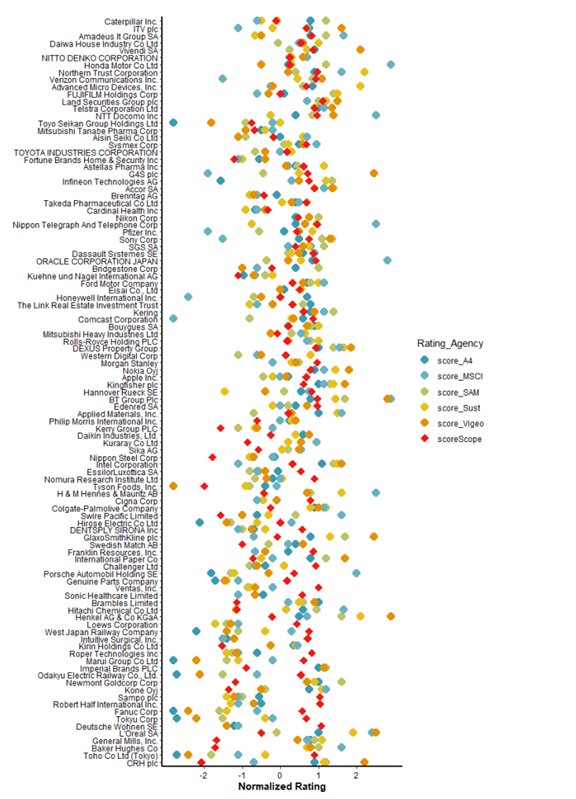

Any future alignment of regulatory standards and agreed measures must be complimented by an improvement in the quality of available ESG data:

- Current ESG ratings are immature, with scores often poorly correlated with each other. - Additionally, the current ratings focus on business models as opposed to the businesses themselves, thus diminishing the impact of what a firm sells, so long as it is manufactured and sold sustainably.

- The scoring systems often measure the wrong things and rely on incomplete, inaccurate figures. [4]

Resolution

Better Standards

The proliferation in regulations has heightened the need to establish a common set of standards for ESG, equivalent to the Generally Accepted Accounting Principles (GAAP) used in financial reporting.

Here, it is essential that a dual mandate of Central Governments forcing firms to improve their disclosure commitments and Asset managers moving towards coherent and measurable objectives, is established.

In the direction of better standards, whilst political and regulatory roadblocks still stand in the way for US investors, the European Union has taken significant strides, having issued a suite of regulations, encompassing all asset managers, investment funds, and other categories of financial services firms.

Better Data

The widespread availability of quantitatively and qualitatively improved ESG data is essential in complementing traditional fundamental analysis.

Here, we are encouraged by the increased participation and investment made by larger data providers which, although still immature, should support those asset managers looking beyond the aggregated scores, intent on create their own ESG ratings.

Better Alternatives

Finally, we are encouraged by developments in the direction of alternative data analysis, especially in regards the decision making surrounding social criteria:

- Thinknum Alternative Data, a research firm, evaluates reviews of companies written by members of staff, which has proven to be highly effective in discovering examples of corporate malfeasance, omitted from traditional disclosures, or overlooked by audits.

- The data company, RepRisk, analyses both articles and think-tank reports, its 2017 risk ratings for Johnson & Johnson, Purdue Pharma and Teva Pharmaceuticals already accounting for an impending opioid crisis long before its eventuation.

- The sentiment analysis of news and other media undertaken by Truvalue labs (now part of FactSet. )

The growing criticality of ESG data to the investment process cannot be overlooked.

Improvements are being evidenced in standards, data contents, and data types seen as essential components required to support investors in the pursuit of two key areas:

- More varied and nuanced ESG targets

- The accurate quantification of inter-relationships between intangible, difficult-to-measure externalities.

While ESG adoption certainly remains in its infancy, the green shoots of spring are appearing once again.

What’s next?

In subsequent blogs in this series, you can expect to read about ESG reporting, the use of alternative data sets (or alt data), the impact on financial returns and the consequences for ESG investing.

[1] According to Datamaran, 40% of S&P 500 companies cite GRI in their sustainability reports.

[2] 25% of S&P 500 constituents refer to SASB in disclosures, up from 5% 20 years previously.

[3] The popularity of both SASB and TCFD has risen in large part due to support from asset managers, including BlackRock and State Street.

[4] Only 50% of companies within the MSCI world index choose to disclose carbon emissions.

And for more from Datactics, find us on Linkedin or Twitter.