Drivers of Self-Service Data Quality in Insurance

An in-depth exploration of the evolving need for self-service solutions in Insurance, covering trends and technologies bringing data quality functions closer to data stewards and business users.

Looking for AI Augmented Data Quality? Head here instead (or as well!).

Topics Covered In This Whitepaper

"As much as 70% of a highly qualified analyst’s time is spent locating and fixing the data."

Leveraging Automation to deliver efficiencies

"While the Insurance industry faces a plethora of challenges with data and analytics, it’s imperative that executives recognize that the quality of the data is fundamental to capitalising on market opportunities."

The Importance of C-Level Buy-In

"AI data scientists can spend up to 80% of their time just preparing input data for machine learning algorithms, which is a huge waste of their expertise"

Preparing Data For The AI Driven Future

A bit about the author

Alex Brown is Chief Technology Officer at Datactics and has over 15 years’ experience in software development and product management, particularly in market data.

Prior to joining Datactics, he was the Head of DART Development at Vela (previously known as SR Labs), and a Market Data Technical Consultant at NYSE Euronext. Alex began his career after completing a BSc (Hons) degree in Physics at Queens University Belfast, where he later added an MPhil in Astrophysics.

Download the whitepaper here

To gain access to this whitepaper, please fill in the form below. You can opt out of communications at any time.

The Datactics Team

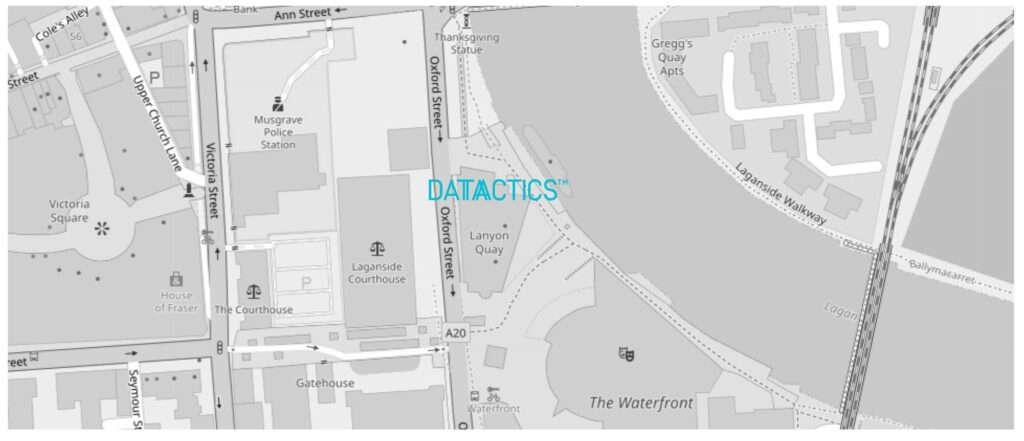

1 Lanyon Quay, Belfast, BT1 3LG

+ 44 2890 233900